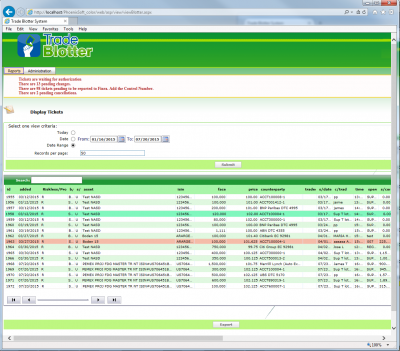

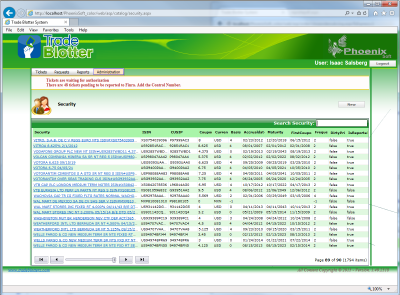

The Application also features a price gap report, which is a useful analysis tool that warns the administrators about unusual price variation between dates selected by the user. The displayed results can show all of the bonds that have been traded, or can also be delimited by ISIN.

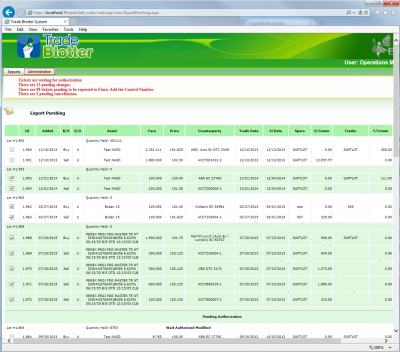

It also generates a report about transactions still pending to be notified to FINRA and if by any given reason they were manually reported, it allows users to add and keep track of the confirmation number.

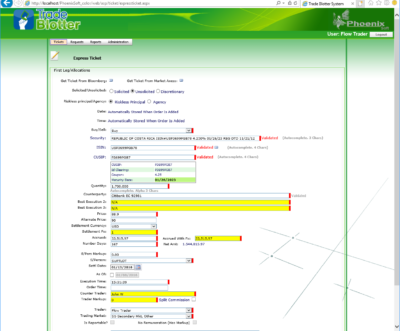

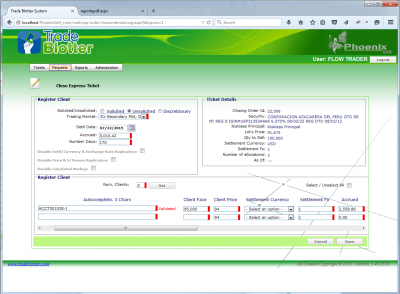

The order’s log has different reports to verify the status of an order, including an Audit Trail report that shows all the order stages. When adding an order the trader/salesperson can choose between 2 options depending on whether or not (sub clearing) they know the client’s/counterparty’s accounts in advance.

The System controls changes and cancellations, the user can verify his cancelled and modified tickets history through the reports module.

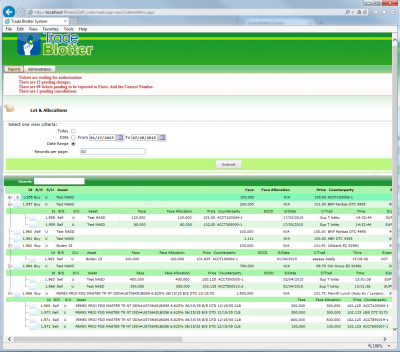

Traders may select many orders at a time, which generates a single lot (1st leg) that groups the respective individual orders, allowing the traders to fulfill multiple orders in a single buy/sell street operation.

The Trade Blotter® System can be used by an unlimited number of users.

Integration with Bloomberg

FIT (Fixed Income Trading) is Bloomberg’s connectivity infrastructure and allows for vinculation with them by using four channels: AEP, FIX, FTP and TradeEmail. Currently, Trade Blotter© is integrated with Bloomberg through the FIX (Financial Information Exchange) protocol, version 4.4. This allows us to obtain tickets captured from Bloomberg directly in our platform without the need to recapture the information.

Integration with MarketAxess

New Module!

The Trade Blotter© now can get tickets directly from MarketAxess using the FIX 4.4 transactional messaging functionality available in the MarketAxess (MKTX) STP gateway and the trading system.